Employer Identification Number (EIN)

One of the crucial steps in starting your business is obtaining an Employer Identification Number (EIN). This unique identifier is essential for tax purposes, opening a business bank account, and hiring employees. At Combinds, we simplify the EIN application process for you, handling all the necessary legal forms and requirements. Our expert team will ensure that your application is completed accurately and submitted promptly, saving you time and effort. Let us take care of obtaining your EIN, so you can focus on what truly matters—growing your business!

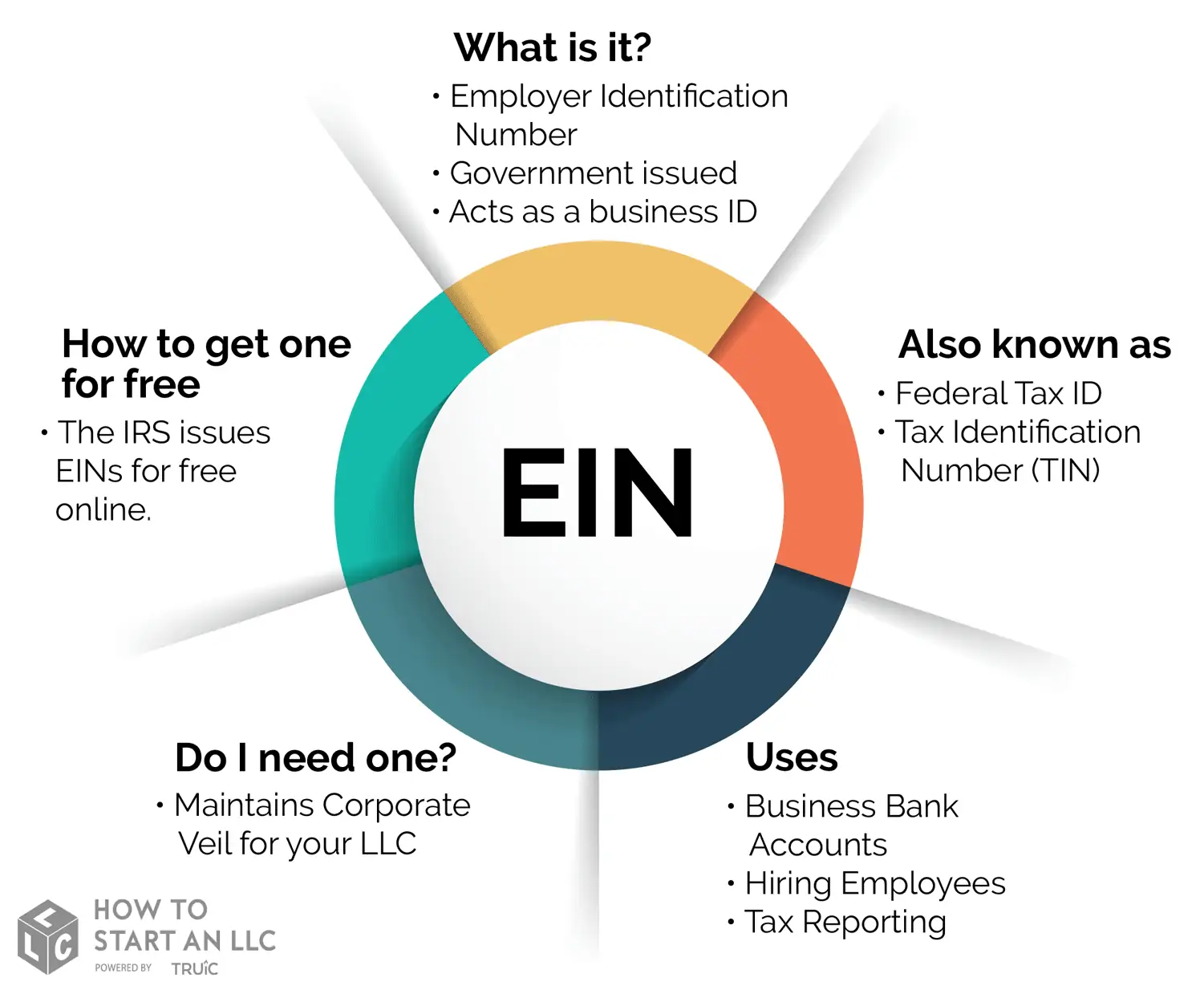

What is an EIN?

An EIN, or Employer Identification Number, is a unique nine-digit identifier assigned by the Internal Revenue Service (IRS) to identify a business entity. Similar to a Social Security Number for individuals, an EIN serves as a crucial marker for legal and financial transactions. It is essential for various activities, including tax filings, hiring employees, and establishing business credit.

Keep in Mind

The EIN is formatted as nine digits in the structure XX-XXXXXXX. The first two digits indicate the geographic area where the business is located, while the remaining seven digits are randomly assigned. Importantly, no two businesses can share the same EIN, ensuring that each entity is distinctly recognized by the IRS.

Benefits of

Obtaining an

EIN

Avoiding Tax Penalties

An EIN is crucial for helping your business avoid tax penalties. This unique identifier ensures that the IRS recognizes and tracks your business separately, streamlining the tax reporting process. Without an EIN, filing taxes can become problematic, leading to potential audits and penalties for non-compliance. By obtaining an EIN, you establish a clear tax identity for your business, which not only helps in maintaining accurate records but also minimizes the risk of costly errors and legal issues down the line. Keeping your business compliant with tax regulations is essential for long-term success and financial stability.

Hiring Employees

If your business plans to hire employees, obtaining an EIN is essential. This unique identifier is required for managing payroll and employment taxes, ensuring that your hiring process complies with legal regulations. Having an EIN allows you to report employee wages, withhold taxes, and fulfill other tax obligations accurately. It not only simplifies payroll management but also helps establish your business as a legitimate employer, fostering trust with your employees and regulatory authorities. In short, an EIN is a vital component for any business looking to expand its workforce.

Prevent Identity Theft

Obtaining an EIN for your business serves as an important safeguard against identity theft. By using this unique identifier for business transactions, you minimize the risk of exposing your personal Social Security Number. This separation helps protect your personal identity and financial information, reducing the chances of fraudulent activity. Using an EIN not only enhances your business’s credibility but also promotes security, allowing you to conduct transactions with greater peace of mind.

Opening a Business Bank Account

A valid EIN is essential for opening a business bank account. This unique identifier allows you to separate your personal and business finances, which is crucial for effective financial management. Having a dedicated business account simplifies the tracking of income and expenses, making it easier to maintain accurate records for accounting and tax purposes. It also enhances your business’s credibility with banks and potential clients, reinforcing your commitment to professionalism. Overall, obtaining an EIN is a key step in establishing a solid financial foundation for your business.

Establish Business Credit

Having an EIN and a dedicated business bank account is vital for building your business credit. When you establish a business account using your EIN, you create a financial identity for your company. This enables you to build a credit history with banks and lenders. If vendors or clients check your business credit, they will see your business as reliable and trustworthy, enhancing your reputation in the marketplace. Strong business credit can open doors to better financing options, larger credit lines, and favorable terms, all of which are essential for growth and sustainability.

How to Obtain an EIN Number

Obtaining an EIN is a straightforward process that can be completed through several methods:

Online Application

The quickest way to get your EIN is by applying online through the IRS website. Simply visit the IRS website and complete the online application form, which is available 24/7. Upon successful submission, you will receive your EIN instantly

Mail or Fax Application

Alternatively, you can fill out Form SS-4 and submit it by mail or fax to the appropriate IRS office. This method usually takes longer to process, typically several weeks if sent by mail. While this option may be less convenient, it’s a viable alternative if you prefer not to apply online.

No matter which method you choose, obtaining an EIN is an essential step for your business that provides numerous benefits and protections.